capital gains tax increase 2021 retroactive

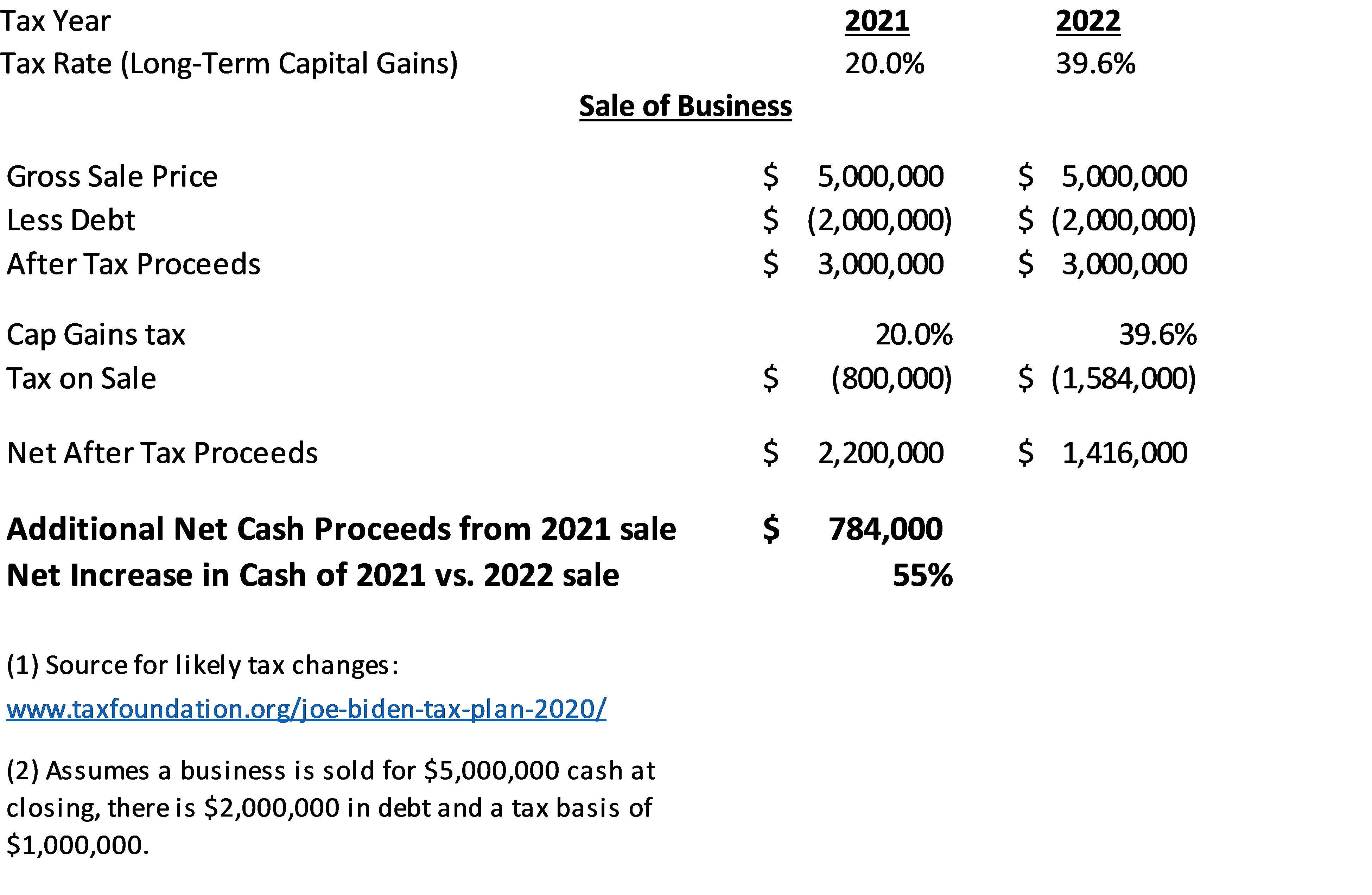

Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary.

A Retroactive Tax Increase Wsj

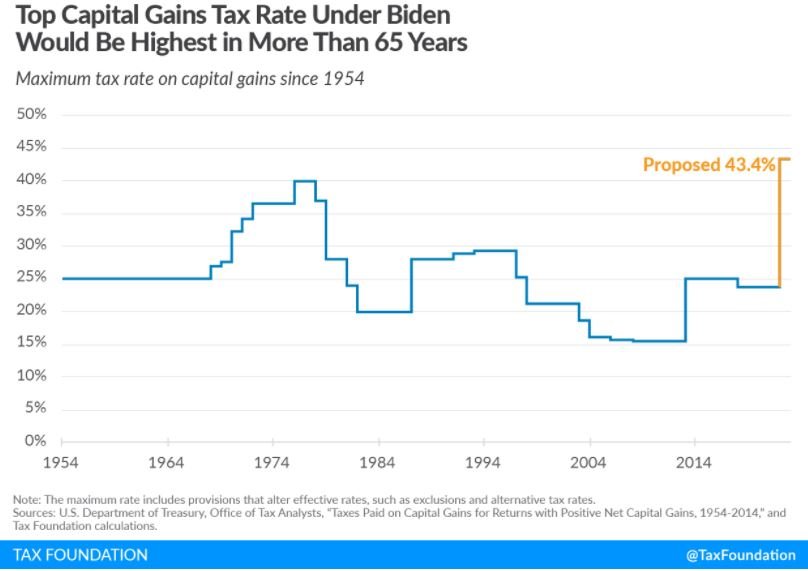

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021.

. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the. The effective date for the capital-gains.

7 rows This leads to the question of whether gains from transactions completed in 2021 but prior to such legislative change could be subject to a. The later in the year that a Democratic tax bill if any is passed the less likely it will have any retroactive effect. Biden has proposed raising the top tax rate on capital gains to 434 percent from 238 percent for households with income over 1 million.

My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. As a result the short-term capital gains rates for 2022 look slightly different than those for 2021. Should the proposals become law your client will now pay federal capital gains tax of 740000 in 2021 and 792000 in 2022 and 2023.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike. Will capital gains change in 2021. Do I have to pay capital gains tax if I have no income.

With this retroactive income tax hike the White. It may already be too late. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

The table also shows the inclusion Eligible. The maximum capital gains are taxed would also increase from 20 to 25. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

One of the big surprises included in President Joe Bidens first budget is the retroactive application of the near 100 capital gains tax hike. The capital gains tax. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have been greater.

This new rate will be effective for sales that occur on or after Sept. Tax brackets change slightly from year to year as the cost of living increases. The later in the year that a.

Yellen Argues Capital Gains Hike From April 2021 Not Retroactive. Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds. Having resolved the infrastructure bill Congress now begins debate and consideration of the budget through a reconciliation process since that can be passed with 50 votes bypassing the normal process that subjects.

7 rows 2021 federal capital gains tax rates. Retroactive Tax Increase. AUGUST 11 2021 BYJOE BISHOP-HENCHMAN.

President Bidens blockbuster 6 trillion budget assumes that his proposed capital-gains tax hike took effect in April according to the Wall Street Journal. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451 in some cases add the 38 Obamacare tax. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan.

Earlier this year President Biden proposed a 2022 budget for the federal government along with a Greenbook explaining corresponding proposed changes to the tax code. June 16 2021 1108 AM PDT Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that. As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains.

13 2021 and will also apply to Qualified Dividends. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75. Below you can find the 2022 short-term capital gains tax brackets.

A Retroactive Tax Increase Wsj

Time Is Running Out Close Before December 31st 2021 For Potentially Significant Tax Savings Newbridge Group

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

Foreign Investment Funds Are Exempt From Withholding Tax On Italian Source Dividends And Capital Gains On Equities Michele Dimonte Andrea Manzitti

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Estimated Taxes Green Trader Tax

A Retroactive Tax Increase Wsj

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

A Retroactive Tax Increase Wsj

How The Potential Tax Changes Can Impact Your Investments Chase Com

A Retroactive Tax Increase Wsj

A Retroactive Tax Increase Wsj

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

Pending Tax Law Changes Mission Wealth

Patrick Are Capital Gains Taxes Changing Local News Valdostadailytimes Com